The Little Book of Value Investing

E**R

Must have for investors

Great book for anyone of any investing experience. I work in the investment space but it’s still a book I’ll thumb through every now and then to re-center myself on how I should be trading

W**E

Great for learners or quick reference

I wish I had bought this book first and recommend others do that before buying Securities Analysis or other BIG books on investing.At first I wasn't liking this book and agree with other reviews that it is a mini-version of Graham and Buffett schooling of which there are already plenty of books about their teachings. The first chapters include lots of anecdotes on past great buys by the author including international accounting practices and other nuances not immediately available to the average person. However I found this book valuable and handy for two reasons:1. Solid introductory advice on the value investing school of thought. Be an investor not a trader. Look at the trend of a data point over TIME, and compare to another RELATIVE FACTOR etc etc.2. There are 3 middle chapters that breakdown the basics of A) the balance sheet B) an income statement and C) 16 questions the author asks himself after reading A & BFor reason #2 I found this book very helpful and added 2 more stars. This is after reading many other books that I'm sure mentioned that stuff, but for some reason it didn't stick. More sophisticated books assume you already know the income statement so when they say "look at operating margins because of XYZ" I am trying to remember what that is each time I read it. Other books offer pages and pages on each item, which I am too busy for right now.I then went into Google docs and made myself a little table of the balance sheet and income statement items. Added comments to each cell that defined them mathematically, aliases for the term, and what the metric tells you. Then added rows for the 16 questions. Added a column of personal targets for each item and some conditional formatting. Finally added in the data from my portfolio and also my stock "Fantasy League". Added the kindle reader app too.Now where ever I go I've got the book's best parts and my breakdown of it in my pocket. So for $10 I'd say got my money's worth and the desire to take time to comment about it. Now I'm reading the Joel Greenblatt Little Book which is pretty good so far too.

D**B

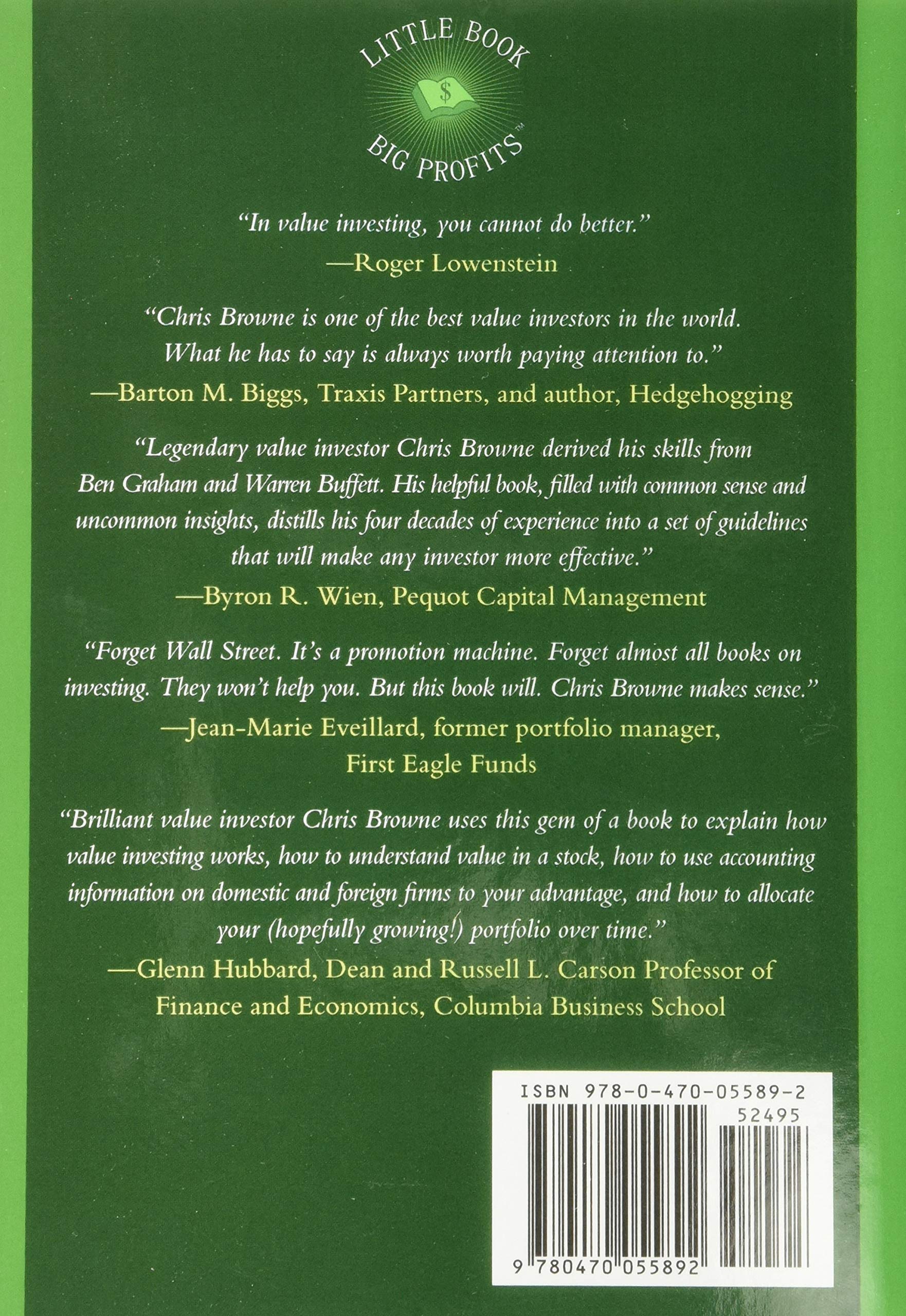

Little Book - Lot of Credibility

In a perfect world markets would offer stocks at prices equaling their value, but they are not and do not. Value investors look for companies that are trading for less than their intrinsic worth. Stocks trading at low p/e ratios, low price-to-book values, or for less than their 'take out' price can be value candidates. Many of these stock prices represent temporary mis-pricings, and that is the point. Patience is a strategy that rewards the value investor as prices eventually adjust upwards to reflect their true worth.Most investors looking for outsized gains focus on companies whose prospects are grand but also widely recognized. Growth investors and momentum investors are inclined to push prices well beyond a company's underlying value and ignore the importance of consistent, if not explosive, growth, and its appreciating assets. It is instructive that the author begins his review of a company by examining its balance sheet for what it is currently worth. By contrast growth investors will focus on a company's income statement for what it may become in the future.Finding a "margin of safety" gives the value investor the confidence to weather the times when his style of investing is out of favor. That margin of safety is foremost in being able to buy solid companies on sale. Owning a diverse portfolio of easily understood businesses with predictable income and a pattern of insider buying or corporate stock buybacks re-enforces that margin of safety (I would also add-in companies that consistently increase their dividends). Identifying suitable value stocks means avoiding cheap stocks of companies that are over-leveraged, facing increased competition, dealing with unfunded pensions, obsolescence or accounting issues. These are the value traps that add nothing to your portfolio prospects.Many of these ideas we have heard before. Browne's accomplishment is to present them in an accessible way. His long tenure as a career investor and money manager and his specific anecdotes got a long way in maintaining his credibility as an advocate of this investing style. Academic studies that support the value approach are noted in the final chapter and bibliography. This is a short, easily read, and informative introduction to the topic.

N**C

Excellent overview for any investor.

As a financial professional, I'm always looking for a book that I can suggest to those who are intimidated by the jargon and math in successful investing. This is THE book I recommend without reservation. Anyone can understand and subsequently execute on the very straightforward and accurate advice in this short read.

T**Y

A Helpful Look At Basic Elements & Equations Of Value Investing

The media could not be loaded. The author Christopher H. Browne holds your hand and clarifies the basic elements and equations that calculate valuations of an equity, such as Price-Earnings, Book Value, Net Asset Value, Cash Flow, and other factors like Buybacks, Insider Trading, and more.The Little Book can definitely help a person with no knowledge of the subject, as it discusses the necessary lines of reasoning of Value Investing, compared to Growth Investing, along with numerous charts and studies that prove his point. However, it did not contain any real examples of the author calculating values in any lengthy manner, as if to show him legitimately valuating an equity. It would have helped a lot if he did a couple real-world examples from top to bottom, instead of only giving elementary examples in the abstract.Again, if you possess no knowledge of Value Investing, give it a shot, but do not expect an aggressive treatment of the subject matter.

K**N

Love this series

Everyone who doesn’t have a financial background should start with little book series. So awesome and easy to follow

Trustpilot

3 weeks ago

2 months ago